|

|

|

Home

View Inventory

"Do You Buy?"

About/FAQ

Show Schedule

Links

|

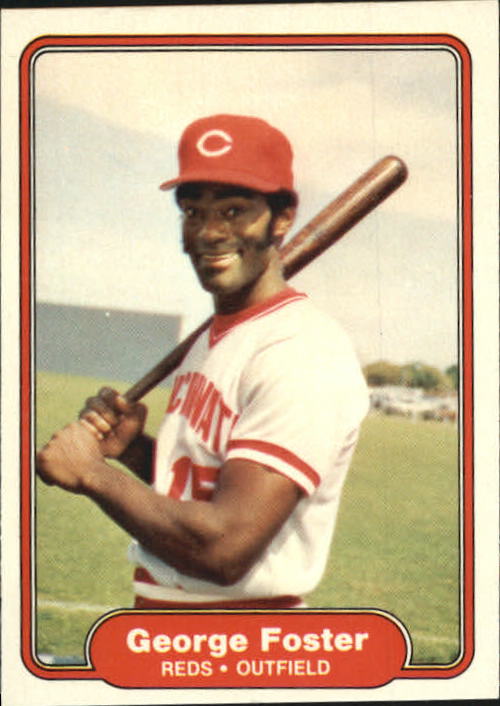

10-10-2016 There's something happening here What it is ain't exactly clear -Buffalo Springfield I think we're experiencing a bubble in the card market. Writing that makes me uncomfortable for a number of reasons. There is certainly no benefit to me sharing that opinion. The best case scenario would be that I'm incorrect and that our beloved collectible market sees upward movement over the next several years. But in the interest of transparency, I don't think that will happen. There is a thread on the Net54 message board I'd like to bring to your attention. I want to spend a moment referencing the initial post by PWCC/Brent Huigens. I'll give him credit for taking off the blinders and at least addressing the possibility that card prices may be riding a bubble and could go down. However, he uses the majority of the post to pimp the scarcity of cards, particularly high-grade blue-chip cards. It shouldn't be lost on anyone that this is his bread and butter. He makes a living charging people a commission to sell their cards. As an aside, I do have a problem with that, and with the people who run most auction houses. They're not dealers. They're simply marketers. They have no exposure to the ups and downs of the market. Their only consideration is generating more consignments and maximizing the prices they receive for cards. Insofar as the market goes, pumping up the hobby is beneficial to them because collectors/investors will be more likely to resell their cards if they can realize a profit, but that's the extent of it. Their message always needs to be that the market is strong. Is it wise for me as a dealer to argue against that? No. Is it wise for an investor to argue against that? No. Is it a feel-good moment for any collector to argue against that? No. This leave us in a tough spot. And it means I'm swimming upstream expressing my opinions in an open forum. Do I think the vintage card market is healthy right now? Hell no. Why aren't we in a good place? Because you're old. Now that you know I'm not pulling any punches, here's a really tough fact to accept. The majority of vintage card collectors are growing older. This negatively hits the supply and the demand sides of the equation. Let's put them together in a chronological timeline: Your average 50s/60s collector has been building their set(s) for years now. They have already picked up all the easy-to-find cards. (Proof. Check eBay for '61 Brooks Robinsons. Weeding out the All-Star card, there are 360 currently available for purchase 24/7.) There is hardly any bit of demand left for this card, but plenty of supply. Auction houses don't see customer wantlists. I do. Basically, all collectors need from the 50s/60s are short-printed Hi# commons - mostly '66s and '67s - and a smattering of rookies and blue-chip stars they've been hesitant to drop the money on thus far. Some people putter around and upgrade their sets, but in large part, collectors of 50s/60s cards are reaching the age where they have to start considering what to do with these completed assets that are probably just sitting in a closet somewhere. Fewer seem to believe that they will be handing down their collections to their kids as an investment. Fewer have children even interested in their cards. So collectors are starting to liquidate while they can. This flip hurts the market in two simple ways - a buyer is subtracted and a seller is added. Supply of cards on the market goes up, and again demand goes down because so few new collectors are coming into the hobby. So why have prices been going up like crazy? I'm glad you asked. And 'crazy' is certainly the right term. For purposes of tracking card prices, Vintage Card Prices (VCP) is the place to go. I would love to sprinkle in all sorts of their data to make my case, but it is a pay site and probably a violation of their terms to do so. Simply put, the site tracks almost all auction sales of graded cards over the past 10+ years. I say "almost" because auction houses have to opt in to have their sales data submitted and posted. But virtually all AHs, plus eBay, do. Corroborating what Brent/PWCC said in his post, a handful of blue-chip cards have seen price explosions over the past couple years. Aaron, Koufax, Mantle, Jordan, Clemente, and many more rookies in some grades are 3x, 5x, 8x higher than levels they had seemingly plateaued at from 2007-2014. VCP graph - Pricing of a random graded HOF rookie card. What do you trust more - the 8 years of stable prices, or the past 2 where they have skyrocketed? Funnel effect Remember when I mentioned the lack of demand for a '61 Brooks Robinson? The same isn't true for Brooks rookies. That is another card which has seen a significant increase in price over the past couple years. One effect of fewer collectors being interested in vintage is that people are gravitating toward HOF rookies and blue-chip players like Mantle, Ruth, and Jordan (even MJ's 3rd/4th/5th year cards have seen significant price jumps lately). I'm on board with these market trends, but not to the extent that prices should rise this much. It's only natural that people are going to remember, and thus collect, the superstars of an era while forgetting the also-ran scrubs. It's natural for collectors to chase rookie cards, scarce cards (ex. Hi#s) and other significant issues (ex. teams from a year they won the World Series). So why are prices going up? Part II People are lemmings. Dealers, collectors, investors. Once the inertia starts the ball rolling, people want to follow the momentum. It happens in every market, not just cards. And it's happened numerous times even in recent card-history. Caramel cards sat unwanted for a long time, then shot up, then fell. Minor league cards experienced a craze and then dropped off. Insert cards...jersey cards...graded Griffey/Bonds/McGwire rookies... Now we're looking at vintage HOF rookies. Just scroll down about 70% of the way in this report to see my friend/customer Jeff discuss the '55 Clemente being the hottest vintage card at this year's National. Two pieces of advice. The first I give over and over again: Collect what you like. It's much harder to go wrong and be disappointed if you're collecting what you enjoy. I recently had a dealer say/ask me, "Your collection must have a bunch of high-end stuff in it." Nope. I collect Jordan cards with badass dunk pics, George Fosters where he's smiling or looking like a murderous maniac, Kerry Wood and Andre Dawson because they're my favorite Cubs, Koufax and Ted Williams in average condition because they're my overall favorites, Marichal because of that crazy leg kick, Avery Johnson because he was on my fantasy team and his voice is funny, and Barry Sanders because he was the best running back I ever watched in person. The other piece of advice, if you're more concerned with the monetary value of your collection comes from Al Czervik of Caddyshack fame. "Then sell, sell sell! They're all selling? Then buy, buy, buy!" Don't be a lemming (or a gopher). So why are prices going up? Part III One difficult part about writing this is that I have unnamed sources - other auction house owners - agreeing with Brent/PWCC. There is a new group of investors buying up Aaron rookies and other RCs. While Brent estimated 10-30, I've heard that there may only be 8. That's a thin group, but my understanding is they have deep pockets. Another thing I understand from other AH owners is that not all cards are being paid for. This is important, and why I titled this column "Trick-quidity." We may be looking at a situation where graded cards are NOT the liquid commodity people think they are. Look at the potential someone has to exploit the current card market. It would be ultra-hard to manipulate a stock price when there are 600+ million shares of Google or nearly 3 billion shares of Facebook outstanding. Instead, you have a much more limited supply of Hank Aaron PSA 8s. Not only that, but note that with VCP reporting virtually every online sale, you have the ability to create an illusion that card prices are going nuts. They don't eliminate any entries if the buyer fails to pay; there is no system for that. If you're reading this and not familiar with VCP, you're just gonna have to take my word that dealers/collectors/investors lean HEAVILY on that data when buying/selling cards. If the data is false, it's creating an even worse bubble. Dropping this on my customers and readers is disheartening. This market is stratified, at best. Prices at the top may or may not be going crazy, but only a few cards are being uplifted. I'm dealing with customers who want (I'm cautious to use "need" in a collecting sense) an Ex condition Koufax RC for their '55 set, but have seen prices rise from $300-350 to $900-1000. Additionally, many eBay sellers of average condition raw vintage cards (Vg and Ex-ish) have seen sales dip significantly over the past couple years. I'm not sure if it's a good time to buy those or not. I'm not confident it's a good time to buy these HOF rookies. While prices of 8s/9s/10s have also seemingly pulled up the values of lower grade cards, if the bubble on the top end bursts, the lower grade cards will be affected as well. I just had to advise a customer/friend of mine that I couldn't fully endorse him buying a '52 Topps Mantle at the moment. Even a lower grade one. I could be wrong, but I feel trepidation at current price level on the blue-chippiest card in the post-war vintage market. That's saying something. I really would like to end this on a positive note. If you're a vintage card collector, this is a frustrating read. But I do believe there are things in the market that have a better chance to appreciate than others. Non-rookie stars in Ex-ExMt condition, especially if they're a little off-center. (I didn't mention the centering fad that is occurring right now...could be a passing fancy as well.) HOFers and stars from tobacco, gum, and caramel issues. Except for Ruth and Cobb, some prices on these have settled. I was just able to pull a dozen cards from Goodwin's recent T206 set break auction. Since I'm not aggressively chasing cards right now, that indicates prices are a little soft. There are probably other things out there too, but my top rule always remains: Collect what you like. After all, if you flip across this card in a box, how can you not smile?

Have fun! -T |